Dr. Richard Encarnacion

- …

Dr. Richard Encarnacion

- …

Institutional Capital | Economic Strategy | Wealth Creation

Dr. Richard Encarnación

Institutional Capital • Global Economic Strategy • Energy, Power & InfluenceI design and deploy financial and energy power structures that move markets, shape national policy, and create durable, generational wealth at institutional scale.

📌 Trusted by governments, policymakers, institutional investors, UHNW families, and global enterprises

📌 $1T+ in structured finance, capital architecture, and global economic strategy engagement

📌 Leading U.S. clean-energy industrialization with multi-factory manufacturing, AI-era energy systems, and government partnerships across 7+ nations🔴 Request Strategic Engagement

🔵 Explore Institutional & Government Services

🟣 Investor & Strategic Network AccessSign Up

Download the Free E-Book

Show Up and WIN BIG⭐ Unlock Institutional Growth & Strategic Advantage with Dr. Richard Encarnación

Institutional Strategy Built to Move Markets

Are you an institutional leader responsible for outcomes measured in tens or hundreds of millions—not presentations?

Generic frameworks don’t shift markets.

Precision-engineered economic, financial, and energy strategies do.Dr. Richard Encarnación partners with institutions, Fortune-level enterprises, governments, banks, and sovereign entities to deliver measurable, enterprise-wide impact, generating $10 million to $1 billion+ in verified value creation.

Institutional Power Levers

Engagements focus on activating high-impact levers that directly affect balance sheets, operating models, and long-term positioning:

Strategic capital repositioning & liquidity optimization

Enterprise-wide cost reduction and operational efficiency at scale

New institutional revenue models and market-expansion pathways

High-level funding strategy, capital raises & structured finance ($10M–$10B+)

Global partnerships and cross-border economic alignment

Clean-energy integration for AI-era grid stability and cost control

Human-capital optimization and organizational restructuring

These are not theoretical initiatives.

They are executed levers tied to financial outcomes.This Is Not Consulting

This is institutional transformation.

Every engagement is engineered to:

Strengthen enterprise resilience

Accelerate competitive advantage

Align capital, energy, and policy

Position organizations for long-term economic leadership

🧭 Institutional Strategy at the Highest Level

With Dr. Encarnación’s direct engagement, institutions gain access to:

System-wide performance and resilience frameworks

Advanced capital architecture and balance-sheet strategy

Integrated energy + financial optimization models

Government-linked expansion and procurement pathways

Structural reforms that unlock hidden enterprise value

The result is measurable financial, operational, and strategic improvement—not advisory output.

Outcome Focus

These strategies are designed to deliver:

✔ Material EBITDA and cash-flow improvement

✔ Reduced energy and infrastructure cost exposure

✔ Accelerated market entry and global expansion

✔ Stronger capital positioning and liquidity resilience

✔ Durable competitiveness in AI- and energy-intensive environmentsOptional Micro-Gate (Recommended)

Engagements are mandate-based and paid. Institutions must demonstrate authority, capital alignment, or deployment readiness.

Dr. Richard Encarnación – Architect of Institutional Capital & Economic Power

Strategic Advisory at the Highest Level of Power

I advise governments, Fortune-level enterprises, hedge funds, sovereign investors, national agencies, and influential leaders on strategies that reshape markets, reconfigure capital, and strengthen national economic power.

My work operates at the intersection of finance, energy, policy, and global systems—where decisions are irreversible, outcomes are measured in billions, and execution determines national advantage.

This is not advisory from the sidelines.

This is direct engagement at the level where economic power is built and defended.Core Areas of Strategic Authority

Structured Finance & Institutional Capital Architecture

Designing sovereign-grade capital structures, liquidity pathways, and balance-sheet strategy.🔹 National & Global Economic Strategy

Positioning nations and institutions for growth, resilience, and long-term competitiveness.🔹 Sovereign Trade, Diplomacy & High-Level Negotiation

Structuring cross-border alignment, trade frameworks, and multilateral economic agreements.🔹 Digital Finance, AI Economics & Power Infrastructure Strategy

Aligning financial systems, AI demand, and infrastructure capacity at national scale.🔹 Wealth Architecture for UHNW Families & Family Offices

Building durable, policy-aware, multi-generational capital systems.🔹 Energy Modernization & Grid Strategy for AI-Era Demand

Designing energy systems capable of supporting AI, advanced manufacturing, and national infrastructure without constraint.Impact at Scale

My strategies have directly influenced and enabled:

✔ Debt restructuring and national balance-sheet repositioning

✔ Sovereign trade agreements and cross-border economic alignment

✔ National economic frameworks for growth, recovery, and modernization

✔ Institutional lending structures and capital markets strategy

✔ Private capital formation, structured finance, and liquidity optimization

✔ Government negotiation strategy producing multibillion-dollar outcomes

✔ National clean-energy pathways powering AI, industry, and infrastructureThese are system-level outcomes, not advisory exercises.

What This Is — and Is Not

I do not teach finance.

I do not coach leaders.

I do not provide theoretical frameworks for exploration.I engineer financial, energy, and economic power systems that scale:

Nations

Institutions

Strategic industries

Ultra-high-net-worth portfolios

This work exists where capital, policy, energy, and influence converge.

Operating Domain

This is the level where:

Countries negotiate.

Institutions scale.

Markets shift.

Fortunes are built.

Energy and economics determine power.If you are operating at the top tier of economic leadership,

I help you win at the top tier.Optional Closing Line (Recommended)

Engagements are selective and mandate-based. This platform is built for execution, not exploration.I advise governments, Fortune-level enterprises, hedge funds, sovereign investors, national agencies, and influential leaders on strategies that reshape markets and strengthen national economic power.

My advisory work spans the highest levels of global finance and policy:

Core Areas of Expertise

🔹 Structured Finance & Institutional Capital

🔹 National & Global Economic Strategy

🔹 Sovereign Trade, Diplomacy & High-Level Negotiation

🔹 Digital Finance, AI Economics & Power Infrastructure Strategy

🔹 Wealth Architecture for UHNW Families & Family Offices

🔹 Energy Modernization & Grid Strategy for AI-Era Demands (new mandate integrated)I don’t teach finance.

I engineer financial power systems that scale nations, institutions, and high-net-worth portfolios.My Strategies Have Influenced:

✔ Debt restructuring & national balance-sheet repositioning

✔ Sovereign trade agreements & cross-border economic alignment

✔ National economic frameworks for growth, recovery & modernization

✔ Institutional lending structures & capital markets strategy

✔ Private capital formation, structured finance, & liquidity optimization

✔ Government negotiation strategy with multibillion-dollar outcomes

✔ National clean-energy pathways powering AI, industry & infrastructure (new mandate integrated)This is not “coaching.”

This is capital. strategy. power.

Delivered at the level where:

Countries negotiate,

Institutions scale,

Markets shift,

Fortunes are built, and

Energy, economics, and influence converge.

If you’re operating at the top tier of economic leadership, I help you win at the top tier.

Books

Published Works by Dr. Richard Encarnación — Read by Executives, Policymakers & Global Investors

'Your 1,000 True LinkedIn Fans,' the ultimate guide to cultivating a devoted following on social media. ""Discover the ultimate strategies for delivering unparalleled value to customers and skyrocketing your success in 'Born to Sell.'

"Embark on the journey to your ideal career with the 'Veteran Transition Guide Book.'

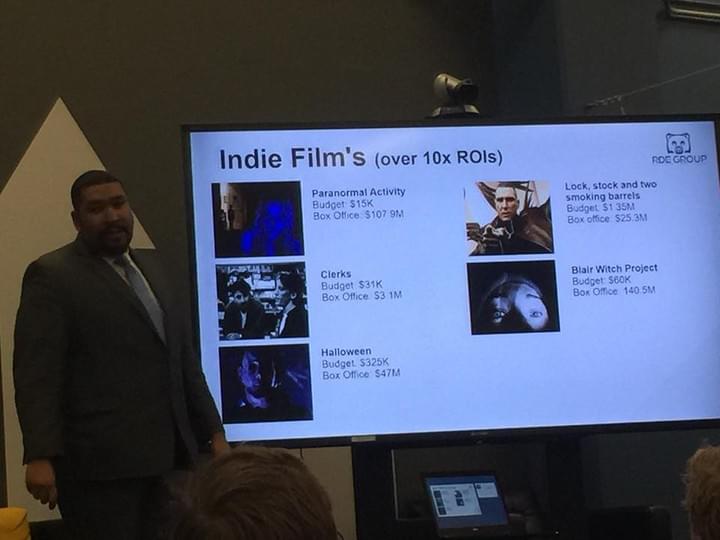

"Show Up and Win Big" unlocks success with Woody Allen's wisdom: "80% of success is showing up."

BENEFITS

We Help Your Institution Win—If You’re Ready to Act on World-Class Strategy.

→ Request a Private Consultation

⭐ Elite Advisory for Leaders Who Influence Markets, Capital & Policy

Below are the core services provided exclusively to institutions, policymakers, and high-impact leaders.If you operate at the top tier — this is where you belong.

🔥 1. Institutional Capital & Trade Advisory

For hedge funds, sovereign wealth entities, family offices, multinational enterprises, banks, and senior policymakers executing at national or global scale.

Typical Deal Size: $10M to $10B+

Mandated Outcomes:

- Strategic capital architecture and balance-sheet optimization

- Cross-border trade structuring and market access

- Global liquidity pathways and institutional capital alignment

- Sovereign-grade financial engineering and risk positioning

This advisory exists where capital, trade, and policy converge—not at the transactional level.

🔥 2. Stock Loans & Alternative Capital Solutions

Institutional liquidity unlocked from publicly traded equity—without sale, dilution, or loss of control.

Designed For:

Public-company shareholders

- Founders and C-suite executives

- Institutional funds and family offices

- UHNW principals with concentrated equity positions

- Strategic Advantages:

Non-dilutive capital deployment

- Rapid underwriting and execution

- Large-facility access ($10M–$1B+)

- Global lender and jurisdictional reach

- This is balance-sheet strategy, not retail lending.

🔥 3. Policy & National Economic Strategy

High-level strategic advisory for governments, ministries, national agencies, and senior economic leadership.

Advisory Scope Includes:

National economic development and competitiveness strategy

- Sovereign trade positioning and geopolitical alignment

- Debt restructuring and financial architecture

- Energy modernization and industrial power systems

- Strategic national finance, liquidity resilience, and market stability

- This is where countries gain durable advantage, not policy rhetoric.

🔥 4. Institutional Intelligence & Global Market Briefings

Private intelligence for banks, funds, sovereign entities, and serious principals requiring foresight—not headlines.

Delivered Intelligence Covers:

Global market and capital cycles

- Sovereign economic shifts and policy realignments

- Institutional capital flows and liquidity movement

- Energy, infrastructure, and frontier-market opportunities

- High-value strategic positioning ahead of consensus

- This is decision intelligence, not retail research.

🔥 5. Executive Strategy & Leadership Intensives

(By Selection Only)

Strategic development for individuals operating at—or moving into—positions of economic, institutional, or political power.

Designed For:

CEOs and board-level leaders

- Institutional investors and principals

- Founders scaling into national or global markets

- Senior policymakers and future national leaders

- This is not coaching.

This is elite strategic conditioning for long-term power, clarity, and influence.

⭐ Work With Dr. Encarnación — Request Strategic Access

Engagements are paid, mandate-based, and selective.

Most inquiries are declined.🔴 Institutional Advisory

Capital, trade, energy, and enterprise-scale execution

🔵 Government & National Strategy

Economic architecture, energy modernization, and sovereign positioning.

🟣 Capital & Financing Solutions

Stock loans, structured liquidity, and institutional funding pathways

Access is selective.

Proof of mandate, capital, or decision authority is required.

This platform is built for execution—not exploration.

⭐ WHY HIGH-LEVEL CLIENTS WORK WITH ME

Because You Want Results — Not Theory.

The leaders who work with me aren’t looking for motivation or ideas.

They come to me when they need someone who can:✔ Move capital — fast, globally, and at scale

✔ Build strategy that actually shifts markets

✔ Structure complex deals from $10M to $10B+

✔ Navigate high-level systems across finance & government

✔ Expand wealth, influence, and institutional power

✔ Create financial outcomes others believe are “impossible”What You Get When You Work With Me

-Institutional-Level Strategy

Frameworks used by hedge funds, sovereign investors, and multinational enterprises.🔥 Government-Level Insight

The ability to operate where policy, economics, and national interest converge.🔥 Investor-Level Execution

Practical, results-driven solutions that produce measurable gains.🔥 Sovereign-Level Economic Understanding

Mastery of systems that shape nations, markets, and global capital flows.This Is Finance at the Highest Level.

Not available to the general public.

Not for beginners.

For leaders who have everything to gain — and everything to lose — if they choose the wrong strategy.

🔵 Institutional & Government Services

Energy systems, infrastructure resilience, capital structuring, policy alignment, and national-scale execution.

Mandate-based. Paid engagements only.🟣 Investor & Strategic Access

For qualified banks, funds, and principals seeking exposure to private energy, infrastructure, and resilience platforms (Honos, N-PEG™, allied systems).

Qualification required. No retail access.Access is selective.

Engagement requires proof of mandate or capital.

This platform is built for execution—not exploration.Every major economic transformation begins with one decisive conversation—

but only when both sides are ready to move.If you are positioned to build at scale, request consideration.

Inspire with Passion to take action.

⭐ READY TO ENGAGE AT THE HIGHEST LEVEL?

I do not work with everyone.

I work with governments, institutions, banks, funds, and principals who are positioned to execute at scale across energy, infrastructure, capital, and policy.

This includes engagement through:

- Honos Infrastructure (energy-aligned financial rails)

- N-PEG™ / Blue Quantum Electric (next-generation energy systems)

- The Encarnación Institute (Resilience-as-a-Service & strategic execution)

If you are looking for theory, exploration, or unpaid dialogue—this is not the right environment.

WHO THIS IS FOR

Engagement is considered only if you represent or control:

✔ Government or public-sector mandate

✔ Bank, institutional, or sovereign capital

✔ Venture or private equity with deployment authority

✔ Energy, infrastructure, or manufacturing operators

✔ Strategic platforms seeking national or global expansionYou must be prepared for paid, structured, execution-focused engagement.

WHAT THIS UNLOCKS

Qualified counterparties gain access to:

N-PEG™ energy deployment pathways

- Honos financial & settlement infrastructure

- Resilience-as-a-Service (RaaS) frameworks

- Capital structuring and institutional alignment

- Government, defense, and enterprise market access

- Multi-country manufacturing and scale strategy

- This is where energy, capital, and power converge—not at the idea level, but at the deployment level.

REQUEST CONSIDERATION

🔴 Apply for Strategic Engagement

For governments, banks, UHNW principals, and institutions with capital or mandate authority.

Applications are reviewed. Most are declined.🔵 Institutional & Government Services

Energy systems, infrastructure resilience, capital structuring, policy alignment, and national-scale execution.

Mandate-based. Paid engagements only.🟣 Investor & Strategic Access

For qualified banks, funds, and principals seeking exposure to private energy, infrastructure, and resilience platforms (Honos, N-PEG™, allied systems).

Qualification required. No retail access.Access is selective.

Engagement requires proof of mandate or capital.

This platform is built for execution—not exploration.Every major economic transformation begins with one decisive conversation—

but only when both sides are ready to move.If you are positioned to build at scale, request consideration.

Dr. Richard Encarnación’s Impact in Energy, Manufacturing & National-Scale Deployment

When energy, manufacturing, and infrastructure operators engage with Dr. Richard Encarnación, they are not hiring a consultant, theorist, or innovation evangelist.

They are engaging an operator of next-generation energy and industrial systems—with active deployment pathways across multiple countries, enterprise environments, and government-aligned corridors.

This work produces measurable outcomes that directly impact:

- Revenue

- Production capacity

- Energy cost structure

- Capital access

- Market expansion

The results consistently translate into 8- and 9-figure value creation at scale.

N-PEG™ & Blue Quantum Electric — From Energy Constraint to Energy Advantage

At the core of Dr. Encarnación’s work is N-PEG™ (Next-Generation Energy Production) and Blue Quantum Electric—a new class of non-nuclear, non-extractive, high-density energy infrastructure engineered for the AI, manufacturing, and defense era.

This is not lab-stage research.

N-PEG™ and Blue Quantum Electric are being positioned for real-world deployment across:

Industrial manufacturing

- Energy-intensive logistics

- AI and compute infrastructure

- Defense and national resilience systems

- Export-aligned trade corridors

- The objective is precise:

remove energy as a limiting factor of economic growth.

From Factory Floor to Global Systems — Not Stuck in R&D

Most energy and manufacturing innovations fail for one reason:

They cannot bridge technology → capital → buyers → policy → deployment.

Dr. Encarnación specializes in closing that gap.

His execution model connects:

✔ Advanced energy systems → manufacturing scale

✔ Manufacturing capacity → institutional and sovereign capital

✔ Energy innovation → government, defense, and enterprise buyers

✔ Production platforms → multi-country deployment

✔ Engineering breakthroughs → revenue and procurement pathwaysThis includes strategic positioning for global showcases, enterprise adoption, and government procurement channels—not exposure for exposure’s sake, but commercial validation and deal flow.

Active Expansion Across Energy, Manufacturing & Defense Systems

Current execution focus includes:

N-PEG™ / Blue Quantum Electric — Energy infrastructure for manufacturing, AI, and national resilience

MRE-P™ (Meal-Ready-to-Elevate) — Advanced nutrition, hydration, and energy systems aligned with defense and logistics readiness

Multi-Country Manufacturing & Deployment Pathways — Including active engagement across nine countries

Enterprise-Scale Relevance — Designed for hyperscale, logistics, and infrastructure environments where reliability and energy density matter.

These platforms are engineered for deployment, procurement, and scale—not consumer speculation or pilot theater.

What Working With Dr. Encarnación Requires

This is not coaching.

This is not advisory for equity only. This is not unpaid collaboration.Dr. Encarnación engages only where there is clear economic alignment.

That means counterparties must bring:

Capital commitment, paid engagement, or structured economic participation

- A real deployment pathway (manufacturing, procurement, or national use case)

- Decision-making authority or direct access to it

- The value delivered operates at the level of:

Energy cost transformation

- Manufacturing acceleration

- Market access and procurement

- Capital and strategic buyer positioning

- Engagement reflects that level of impact.

Proven Outcomes, Real Execution

Through direct execution and strategic deployment, Dr. Encarnación has enabled organizations to:

Transition energy and manufacturing systems from pilot to commercial scale

Secure institutional capital and strategic buyers

Reduce energy and operational constraints at scale

- Enter government, defense, and enterprise procurement environments

- Convert intellectual property into revenue-producing infrastructure

Build platforms capable of global expansion, not local proof points

This Is Where Energy, Manufacturing & Power Converge

Dr. Encarnación operates at the intersection of:

Energy • Manufacturing • Capital • Policy • Markets

Where:

Infrastructure is built

- Supply chains are secured

- Energy constraints are eliminated

- And economic power is shaped

- If your objective is to build or scale a 7–10 figure energy, manufacturing, or infrastructure platform—and move it from production to global, institutional adoption—

This is the level of execution required.

Optional Closing Line (Recommended for Filtering)

Engagements are limited and structured. Dr. Encarnación works only where there is clear economic alignment and deployment intent.

Dr. Richard Encarnación’s Impact in Energy, Manufacturing & Market Expansion

When energy, fuel, and manufacturing companies work with Dr. Richard Encarnación, they don’t get theory, frameworks, or motivational consulting.

They get results that move revenue, production, and market share.

Across energy, industrial manufacturing, and infrastructure-driven businesses, Dr. Richard’s strategies have helped organizations:

- Increase enterprise productivity by 30%–500%

- Reduce operational and energy-related costs at scale

- Accelerate manufacturing-to-market timelines

- Secure institutional capital and strategic buyers

- Transition from pilot-stage concepts to commercial-scale deployment

- Position products and platforms for global adoption and government procurement

These outcomes consistently translate into 7-, 8-, and 9-figure value creation.

From Manufacturing to Market — Not Stuck in the Lab

Many energy and manufacturing companies fail not because the technology doesn’t work —

but because they cannot connect production to capital, buyers, policy, and distribution.Dr. Richard specializes in closing that gap.

His work connects:

✔ Manufacturing capacity → institutional capital

✔ Energy innovation → government and enterprise buyers

✔ Production systems → global markets

✔ Engineering teams → commercial execution

✔ Technology → revenueIncluding strategic positioning for global showcases, procurement channels, and commercialization pathways (including CES-style market exposure and enterprise adoption).

Proven Outcomes Across Sectors.

Through advisory, strategy, and execution support, Dr. Richard has helped leaders and teams:

Build and scale energy and fuel ventures into multi-million and nine-figure enterprises. Raise private and institutional capital for manufacturing expansion.

Secure enterprise, government, and international buyers

Navigate regulatory, trade, and policy environments

Transition veterans, engineers, and operators into high-impact leadership roles.

Turn intellectual property and innovation into commercialized, revenue-producing systems

This Is Not Coaching. This Is Commercial Execution.

Dr. Richard works at the intersection of:

Energy • Manufacturing • Capital • Policy • Markets

Where real money is made, real infrastructure is built, and real influence is established.

If your goal is to build a 7–10 figure business in energy, fuel, or manufacturing —

and take it from factory floor to global market —

this is the level of strategy required.🔴 Book a Strategic Consultation with Dr. Richard Encarnación

For institutions, governments, UHNW leaders & serious investors.

⭐ Apply for Private Advisory Access

📌 Stock Loans & Capital Solutions

- Stock-Based Lending ($10M–$1B) – Secure liquidity without selling assets.

- HNW & Institutional Financing –

- Tailored financial structures for elite investors.

Media & Thought Leadership

Media & Thought Leadership

🔹 Featured Contributor to leading financial, economic, and technology platforms—recognized for insights on global finance, structured capital, DeFi innovation, and the future of economic systems.

🔹 Keynote Speaker at international conferences covering institutional finance, economic strategy, digital transformation, AI-driven markets, and sovereign capital systems.

🔹 Published Author of multiple works on economic architecture, wealth creation, capital markets, and the evolution of financial power structures across the Americas and globally.

🔹 Strategic Commentator on U.S.trade, monetary policy, sovereign economics, and institutional capital trends influencing global markets.

📩 Press, Media, or Speaking Requests?

→ Contact for Interviews & AppearancesRecommended

⭐ Medium Business Advisory

The Success System™ — Scaling Companies to $10–$50 Million Annually

This advisory is designed for founders and executive teams who have traction—and now need precision strategy, capital alignment, and systems that scale.

Book A Executive Business Advisory:

Book session

⭐ Medium Business Advisory

The Success System™ — Scaling Companies to $10–$50 Million Annually

This advisory is designed for founders and executive teams who have traction—and now need precision strategy, capital alignment, and systems that scale.

Focus Areas:

• Revenue acceleration & margin expansion

• Capital structure & liquidity planning

• Operational systems for scale

• Leadership execution & accountability

• Market expansion & strategic positioning🔴 Book an Executive Advisory Session

⚙️ Executive Business Advisory

For CEOs and leadership teams navigating growth, complexity, and institutional readiness.

Outcomes Delivered:

• Clear growth roadmap

• Executive decision frameworks

• Capital-readiness & funding strategy

• Risk mitigation & governance alignment

• Scalable operating models- 🔵 Book a Private Session

📌 Commercial Real Estate Financing

Institutional Capital for $100M–$1B+ Developments

This advisory is built for corporations, institutional sponsors, family offices, and UHNW principals executing large-scale commercial real estate transactions.

What We Structure:

- Structured Debt & Equity Financing

- Institutional Capital Stacks (Senior, Mezzanine, Preferred Equity)

- Cross-Border & Offshore Capital Solutions

- Project-Level & Portfolio Financing

- Recapitalizations, Refinancings & Strategic Exits

Asset Classes Supported:

- Mixed-use & large-scale developments

- Industrial & logistics portfolios

- Hospitality & destination assets

- Office, medical & specialty real estate

- Energy-adjacent & infrastructure-backed projects

This is not retail lending.

This is institutional capital engineering for projects where precision, discretion, and execution matter.🔴 Book a Private Capital Consultation

For VIP clients, corporations & institutional sponsors only.

Let’s build financial power—at scale.

Media & Thought Leadership

Dr. Richard Encarnación is a recognized voice on global finance, institutional capital, energy-driven economics, and the future of sovereign and market power.

His insights are sought by media, conferences, and institutions looking for clarity, authority, and forward-looking analysis—not surface-level commentary.

Media & Platform Presence

🔹 Featured Contributor to leading financial, economic, and technology platforms, providing analysis on global finance, structured capital, DeFi innovation, AI-driven markets, and emerging economic systems.

🔹 Keynote Speaker at international conferences addressing institutional finance, economic strategy, digital transformation, energy-powered markets, and sovereign capital systems.

🔹 Published Author of multiple works on economic architecture, wealth creation, capital markets, and the evolution of financial power structures across the Americas and global markets.

🔹 Strategic Commentator on U.S. trade policy, monetary systems, sovereign economics, and institutional capital trends shaping global investment and geopolitical outcomes.Dr. Encarnación’s commentary is grounded in real-world execution, advising governments, institutions, and investors operating at scale.

📩 Press, Media, or Speaking Requests

For interviews, expert commentary, keynote engagements, or executive briefings:

🔴 Request Media or Speaking Availability

Available for financial media, policy forums, investor conferences, and high-level institutional events.

Your next level of growth isn’t accidental — it’s engineered.

Let’s unlock the systems, capital, and strategy that move your business forward.

Speaking With Purpose and Power

High-impact keynote presentations that engage attention, inspire action, and deliver clarity—even in the most crowded, distracted environments.

Coaching for Change

Battlefield-proven thinking applied to business, leadership, and life — engineered to cut through obstacles and drive progress.

How It Works

Ready to scale? Let’s discuss next steps.

1Choose

You choose the advisory service, program, or strategic support you need.

Submit your request through our contact form or by email.2Introduction

Our team contacts you to schedule a private discussion via phone or Zoom.

This session clarifies objectives, scope, and next steps.A formal strategy call is conducted to define the engagement and quote.

3Deliver

Once terms are confirmed, an invoice is issued and onboarding begins.

Most engagements start within 24–48 hours.Execution is direct, confidential, and results-driven.

📩 Subscribe to The Wise Newsletter

Strategic insights on capital, markets, leadership, and global trends.

👉 bit.ly/TheWiseNewsContact US

Serious business only. Apply to work together.

⭐ CONTACT — PRIVATE STRATEGIC ACCESS

Contact Dr. Richard Encarnación

📞 Direct: (619) 494-0280

📧 Email: Richarde@therdegroup.com

🌍 Website: www.RichardEncarnacion.com

Serious Inquiries Only

My advisory work is reserved for policy leaders, UHNW investors, institutions, family offices, and senior executives operating at a high financial and strategic level.

This is not general consulting.

This is private, high-stakes advisory for those making consequential decisions involving millions to billions in capital, assets, or economic impact.

What You Can Expect

✔ Strict Confidentiality

✔ Institutional & Government-Level Strategy

✔ Capital, Policy & Market Alignment

✔ Execution-Oriented Advisory

✔ Measurable Financial Outcomes

📩 Request a Private Consultation

If you are responsible for capital allocation, institutional growth, national strategy, or large-scale expansion, this conversation will be worth your time.

Access is selective. Engagements move quickly.

🚀 The future of wealth, power, and finance is built by those who act decisively.

If you’re ready to operate at that level, initiate contact now.

Minimum engagement thresholds apply. Not suitable for early-stage or retail inquiries.

Get in Touch with Dr.RE!

Contact us today!

If you’re serious about results, let’s talk.

Governments, Corporations

The Opportunity to Work, Invest with Richard Encarnacion

The Encarnación Institute

Resilience-as-a-Service (RaaS) for the New Economic Era

Why the Encarnación Institute Exists

The global economy has entered a period of continuous disruption.

Energy transitions.

AI acceleration.

Supply-chain fragmentation.

Financial system stress.

Geopolitical realignment.These shifts are no longer cyclical — they are structural.

The Encarnación Institute was created to address this reality by delivering Resilience-as-a-Service (RaaS): a strategic, institutional-grade framework that helps governments, enterprises, and capital allocators anticipate, absorb, and adapt to systemic change.

This is not a think tank.

It is an operational resilience platform.What Is Resilience-as-a-Service (RaaS)?

RaaS is the continuous provision of economic, energy, financial, and infrastructure resilience as a structured service — not a one-time advisory engagement.

Through the Institute, resilience is delivered via:

Economic stress-testing and scenario modeling

- Energy and infrastructure continuity frameworks

- Capital structure and liquidity resilience design

- Technology transition readiness (AI, automation, digital finance)

- Policy-aligned public–private deployment pathways

- Resilience becomes measurable, deployable, and ongoing.

Who the Institute Serves

The Encarnación Institute works with:

Governments and public authorities

- Institutional investors and family offices

- Infrastructure, energy, and industrial operators

- Enterprises exposed to technology and supply-chain disruption

- Policy-aligned stakeholders managing long-term national or regional risk

- These are organizations that cannot afford failure, downtime, or strategic drift.

Core RaaS Domains

🔹 Energy & Infrastructure Resilience

Ensuring continuity as grids modernize, energy systems decentralize, and industrial demand increases.

🔹 Financial & Capital Resilience

Designing asset-backed, policy-aligned capital structures that remain stable through market shocks.

🔹 Technology & AI Transition Resilience

Helping institutions adapt to automation, AI, and digital financial rails without destabilizing operations.

🔹 Supply-Chain & Industrial Resilience

Re-architecting manufacturing and trade corridors for redundancy, sovereignty, and scalability.

🔹 Policy & Sovereign Alignment

Aligning resilience strategies with national priorities, regulatory frameworks, and public-private mandates.

The Institute’s Strategic Network

Resilience cannot be delivered in isolation.

The Institute operates a working network of principals across:

Governments and policy bodies

- Institutional capital and family offices

- Energy, infrastructure, and industrial leadership

- Cross-border trade and strategic finance stakeholders

- This is not a membership community.

It is an execution network.

Why This Model Matters Now

Technology is moving faster than institutions can adapt.

Organizations that rely on:

Static plans

- Legacy infrastructure

- Fragmented advisory models

- will fail under the next wave of disruption.

The Encarnación Institute exists to ensure its partners remain operational, solvent, competitive, and sovereign-aligned through continuous change.

Position Yourself for the Next Decade

If your objective is to:

✔ Operate through technological disruption

✔ Secure energy, capital, and infrastructure continuity

✔ Align strategy with policy and sovereign priorities

✔ Build durable systems instead of reacting to crisesThen Resilience-as-a-Service is not optional — it is foundational.

Request Strategic Engagement

Engagement is selective and qualification-based.

📩 Request RaaS & Strategic Resilience Access

Eligibility, discretion, and alignment criteria apply.Key 1 — Government-Linked, Energy & Asset-Backed Opportunities for Elite Investors

At RichardEncarnacion.com, we provide qualified investors with direct access to institutional-grade opportunities at the intersection of:

- Energy infrastructure

- Sovereign and government-aligned projects

- Asset-backed and gold-linked financial platforms

- Large-scale capital deployment across emerging and developed markets

These opportunities are designed for UHNW individuals, family offices, institutions, strategic partners, and government-aligned investors seeking long-term, defensible value creation at national and global scale.

Core Investment Domains

• Energy Infrastructure & Industrial Platforms

Clean energy generation, grid modernization, fuel alternatives, manufacturing buildouts, and energy systems supporting AI, industry, and national development.• Sovereign & Government-Engaged Projects

Opportunities involving direct or indirect collaboration with national governments, ministries, and public-sector stakeholders, including state-to-state and public–private frameworks.• Gold & Asset-Backed Capital Platforms

Structured platforms utilizing hard assets, commodities, and sovereign-aligned collateral structures designed for capital preservation, scalability, and strategic deployment.• Institutional Liquidity & Structured Finance

Stock-based liquidity, alternative financing, infrastructure funding, and large-scale capital structuring for projects ranging from $50M to multi-billion-dollar deployments.• Strategic Economic & Policy Alignment

Projects structured with awareness of trade policy, monetary dynamics, national interest, and long-term geopolitical considerations.Investment Philosophy

Our approach prioritizes:

✔ Real assets over speculation

✔ Energy and infrastructure over hype cycles

✔ Government alignment over isolated ventures

✔ Scalable systems over single-point opportunities

✔ Capital protection alongside asymmetric upsideThese structures are built for durability, long-term growth, and institutional participation, not retail speculation.

Who This Is For ?

This page is intended for:

UHNW investors & family offices

- Sovereign and quasi-sovereign entities

- Institutional capital partners

- Strategic energy and infrastructure investors

- Principals seeking exposure to nation-scale opportunities

This is not a public offering and not suitable for retail investors.

📩 Investor Access & Strategic Discussions

Qualified investors may request a private briefing to explore current and upcoming opportunities.

🔴 Request Investor Access

Eligibility and minimum participation thresholds apply.Key 2 — A Proven Record of Global Influence, Scale & Execution

Our work is grounded in real-world execution across capital markets, energy

systems, and government-aligned initiatives, supported by a long-standing record of high-level participation and strategic outcomes.

Demonstrated Experience Includes:

- Large-scale financial structuring and transaction leadership across capital markets, infrastructure, and institutional finance

- Engagement with Fortune-level enterprises, government entities, and global institutions on strategy, funding, and economic alignment

- Participation in international economic forums, policy discussions, and institutional finance environments, including multilateral and cross-border contexts

- Access to proprietary deal flow and strategic opportunities sourced through institutional, sovereign, and enterprise relationships

This experience enables investors to participate in opportunities that are designed, vetted, and structured at an institutional and government-aware level—not retail or speculative environments.

Priority Access for Qualified Investors

Qualified participants gain priority exposure to select opportunities involving:

Energy infrastructure & industrial-scale projects

- Government- and sovereign-engaged initiatives

- Asset-backed and hard-asset–linked capital structures (including commodities and gold-related platforms)

- Advanced liquidity and structured finance solutions

- Institutional funding vehicles engineered for durability and long-term strategic growth

- Strategic Approach

Every opportunity is structured with a focus on:

✔ Capital protection and structural integrity

✔ Alignment with government, policy, and regulatory realities

✔ Energy and real-asset fundamentals over speculative cycles

✔ Scalable systems capable of national and international deployment

✔ Precision-executed financial strategy designed for long-term relevanceThis is not volume-driven investing.

This is strategic capital placement at the intersection of energy, assets, and sovereign economics.Important Note

Opportunities referenced here are not public offerings and are made available only to qualified investors and strategic partners through private discussions.

Key 3 — Join an Elite Network of Global Investors, Governments & Economic Decision-Makers

By engaging with our platform, you become part of a high-level network of capital allocators, institutional investors, corporate leaders, and government-aligned stakeholders operating at the intersection of energy, infrastructure, and global economic strategy.

This is not a membership group.

It is a working network of principals involved in capital deployment, national development, and large-scale economic systems.Participants include:

- UHNW individuals and family offices

- Institutional and strategic investors

- Energy, infrastructure, and industrial leaders

- Government-aligned partners and advisors

- Cross-border capital and trade stakeholders

What Access Really Means

Through this network, qualified participants gain exposure to:

Energy and industrial projects with national and regional impact

- Government-engaged and public–private initiatives

- Asset-backed and hard-asset–linked capital structures

- Institutional liquidity and strategic finance opportunities

- Cross-border partnerships aligned with policy, trade, and long-term economic priorities

- Every engagement is structured with clarity, discretion, and strategic intent—not speculation or mass-market participation.

Position Yourself Where Decisions Are Made

This network exists for those who want to operate ahead of markets, alongside governments, and at the level where capital shapes outcomes.

If your objective is to:

✔ Participate in energy and infrastructure systems, not trends

✔ Align capital with government and sovereign priorities

✔ Build durable wealth through real assets and scalable platforms

✔ Engage with peers who influence markets and policyThen this is the environment you belong in.

📩 Request Strategic Access

Participation is by qualification only.

🔴 Request Investor & Strategic Network Access

Eligibility thresholds and discretion apply.Political Initiatives

Passion

Purpose & Leadership

I founded the Dominican American Coalition Political Action Committee (DACPAC) to advance principled political engagement, economic opportunity, and institutional representation for Dominican Americans and allied communities within the United States.

DACPAC was established to operate lawfully, transparently, and in full compliance with U.S. election and governance standards, with a focus on policy, economic empowerment, and civic participation at the national level.

Governance & Accountability

In alignment with best practices for institutional integrity, DACPAC’s operations have been voluntarily paused while awaiting formal administrative clarification from the appropriate U.S. government authorities.

This decision reflects a commitment to:

- Regulatory compliance

- Responsible governance

- Long-term institutional credibility

Temporary suspension is a standard risk-management and governance action when operating at the intersection of politics, finance, and public influence.

Independence

In parallel, DACPAC helped initiate the Minority Economic Forum (MEF)—a minority-focused economic and financial platform designed to expand access to capital, education, and enterprise development.

MEF was progressing through formal nonprofit structuring when political pressure and external interference emerged. Rather than compromise the organization’s mission or integrity, I chose to prioritize independence, transparency, and personal accountability over expediency.

Neither DACPAC nor MEF exists to serve partisan agendas or external interests.

They exist to build durable economic institutions, advance lawful participation, and protect community credibility.Principle Over Politics

I do not retreat under pressure.

I pause, assess, and restructure when necessary to protect long-term outcomes.My work—across finance, policy, and economic development—has always been guided by:

- Rule of law

- Institutional discipline

- Ethical leadership

- Strategic patience

These principles remain unchanged.

Looking Forward

Political engagement, like capital formation, requires timing, structure, and discipline.

All future initiatives—political or economic—will continue to be executed with:

✔ Compliance

✔ Strategic clarity

✔ Institutional rigor

✔ Long-term national interestCourage

I led one of the first large-scale, structured public dialogue initiatives in the United States addressing the complex and sensitive issues between Dominican and Haitian communities, including border policy, historical narratives, and the ongoing humanitarian crisis.

Over a sustained period of approximately 18 months, these forums evolved from highly charged exchanges into disciplined, moderated, and evidence-based discussions, bringing together members of both communities in a format grounded in facts, historical records, and international law.

More than 200,000 Haitian participants attended or engaged with these debates across live sessions and distributed forums—making it one of the largest cross-community political and historical dialogue efforts of its kind.

During these sessions, I presented documented historical, legal, and academic sources that directly challenged widely circulated inaccuracies held by certain political figures, commentators, and institutions. These discussions included contributions from politicians, historians, academics, and policy advocates, and resulted in formal institutional responses, including hundreds of petitions submitted to major academic institutions requesting review and correction of disputed material.

As is often the case when entrenched narratives are challenged, these efforts also generated organized political resistance and coordinated criticism from actors with pre-existing political agendas. Rather than retreat, I maintained a commitment to open discourse, factual rigor, and peaceful engagement, even in the face of external pressure.

This work demonstrated that courageous leadership is not about provocation, but about the willingness to:

- Host difficult conversations

- Confront misinformation with evidence

- Protect free dialogue across communities

- Absorb political pressure without abandoning principle

Progress requires courage—not silence.

Sovereign Claimant - 🔒 Lawsuits, Legal Standing & Sovereign Protections

Legal Standing, Sovereign Claims & International Protections

Dr. Richard Encarnación has initiated and maintained formal legal actions and sovereign claims across multiple jurisdictions, addressing matters of economic interference, civil and constitutional protections, intellectual property rights, and international treaty obligations.

These filings are part of a broader strategic legal framework focused on protecting sovereign interests, restoring economic rights, and asserting standing under applicable domestic and international legal mechanisms.

His legal matters have included proceedings and submissions involving:

🔹 The Kingdom of Spain — historical and contemporary sovereign and economic claims

🔹 The People’s Republic of China — allegations relating to economic interference and strategic disruption

🔹 International Intellectual Property Bodies (including WIPO) — digital sovereignty, authorship, and IP protection.

🔹 U.S. Federal Agencies (including DOJ & VA) — civil rights, whistleblower protections, and constitutional mattersThese actions are substantive and ongoing, not symbolic. They form part of a long-term legal strategy involving asset protection, economic redress, and sovereign recognition frameworks, pursued through established legal and diplomatic channels.

To ensure transparency and compliance in all international engagements, Dr. Encarnación maintains formal registration and disclosure where required under the Foreign Agents Registration Act (FARA) and adheres to applicable U.S. and international compliance standards in matters involving foreign governments and cross-border advisory activity.

His legal positioning is informed by international human rights principles, including frameworks referenced under UN General Assembly Resolution 60/147, as well as historical, ecclesiastical, and customary legal doctrines where applicable.

This combination of:

- Active legal posture

- Military and public-service background

- Advanced academic training

- Cross-border economic and policy expertise

positions Dr. Encarnación as a rare practitioner operating at the intersection of law, sovereignty, economics, and international strategy.

🛡 Why ASE‑PAC Was Created (ASE‑PAC.org)

Why ASE-PAC Was Created

ASE-PAC (American Strategic Economic PAC) was founded to advance a new era of U.S. economic strategy, sovereign protection, and institutional resilience in a rapidly shifting global landscape.

Amid rising geopolitical tensions, foreign economic interference, domestic policy failures, and widening inequality across minority and diaspora communities, it became clear that America needed a new strategic platform—one focused on economic sovereignty, capital protection, and national competitiveness.

The Mission Behind ASE-PAC

ASE-PAC was created to:

🔹 Protect America’s economic interests against global market manipulation, foreign influence, and asymmetric financial threats.

🔹 Support sovereign families and American-born economic stakeholders whose generational assets and intellectual property are exposed to exploitation.

🔹 Advance policy frameworks that strengthen U.S. competitiveness in finance, trade, energy, manufacturing, and AI-driven industry.

🔹 Provide political and economic representation for Caribbean-American, Hispanic, African-American, and underserved communities who historically lacked institutional access to capital.

🔹 Mobilize structured capital for economic development, minority enterprise growth, and national strategic industries.Alignment With the Sovereign Gold Platform (SGP)

ASE-PAC works in direct alignment with the Sovereign Gold Platform, a strategic economic framework built to:

🔹 Strengthen U.S. financial stability against BRICS-aligned strategies

🔹 Support gold-backed liquidity for institutional and national development

🔹 Rebuild the American manufacturing, energy, and AI-driven infrastructure corridor

🔹 Reinforce sovereign economic security across the United States and Caribbean regionSub-Entities & National Impact

ASE-PAC strategically operates alongside:

🔹 DACPAC (Dominican American Coalition PAC) – Advancing economic, political, and civil empowerment for Dominican-American communities.

🔹 MEF (Minority Economic Forum) – Mobilizing capital, policy reform, and financial education for minority populations nationwide.A New Movement in American Economic Leadership

ASE-PAC is not a traditional PAC.

It is a strategic institution, built to:✔ Anchor U.S. economic sovereignty

✔ Protect generational assets

✔ Combat exploitation & economic discrimination

✔ Drive capital into underserved communities

✔ Shape the next era of American and global economic powerASE-PAC exists to defend, develop, and deploy economic strength, policy innovation, and sovereign protection for the benefit of the nation, its allies, and its historically marginalized citizens.

⚖️ Ongoing Lawsuits We Are Actively Pursuing

⚖️ Active Legal Actions & Sovereign Claims

Dr. Richard Encarnación is currently advancing multiple high-impact legal actions addressing alleged sovereign violations, economic interference, civil rights abuses, and international treaty breaches. These matters span U.S. federal courts and international legal forums and are being pursued through formal legal channels.

Current Matters Include:

🔹 Kingdom of Spain

Claims exceeding $250B relating to alleged historic and modern sovereign suppression, land misappropriation, archival seizure, and unauthorized use of dynastic records and titles.🔹 People’s Republic of China

Claims exceeding $30T involving alleged economic interference, asset diversion, and sovereign economic sabotage, including actions impacting U.S.-linked financial and strategic systems.

(All claims are asserted through lawful legal processes and subject to adjudication.)🔹 United States Federal Agencies (DOJ, VA, FEMA)

Multiple civil rights, whistleblower, and retaliation claims alleging:- Obstruction of federally mandated benefits

- Retaliation against protected disclosures

- Due-process violations

- Interference with lawful security and reporting protocols

🔹 WIPO & International Intellectual Property Bodies

Actions concerning alleged digital sovereignty violations, intellectual property theft, treaty non-compliance, and failure to restore registered sovereign trademarks, titles, and protected assets.Legal Positioning & Scope

These proceedings are not symbolic. They represent:

Significant claims for economic restitution and asset recovery

Enforcement of sovereign, civil, and treaty-protected rights

A broader legal strategy aimed at long-term recognition, protection, and restoration of economic and legal standing

All matters are being pursued in coordination with legal counsel, in accordance with U.S. law, international legal frameworks, and applicable human-rights conventions.

Important Notice

- All claims described above are allegations under active legal review and remain subject to judicial determination. No outcome is implied or guaranteed.

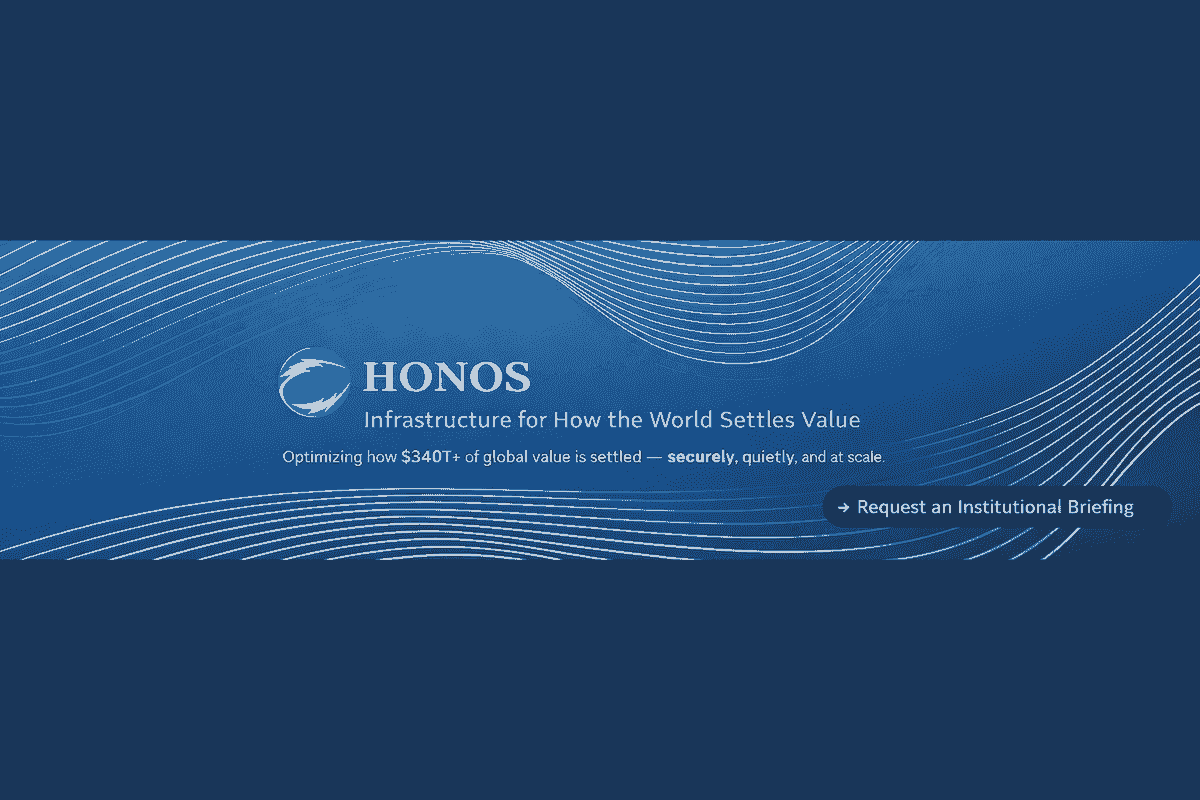

Honos — Infrastructure for How the World Settles Value

Honos Infrastructure

Honos is a next-generation digital financial infrastructure engineered to converge clean energy systems, advanced blockchain rails, and institutional-grade financial architecture.

Designed to meet the growing global demand for sustainable, efficient, and resilient economic systems, Honos introduces an energy-aligned financial rail—built for governments, institutions, enterprises, and large-scale economic deployment, not retail speculation.

This is not a consumer crypto project.

It is foundational infrastructure.Project Background & Strategic Evolution

Honos was initially introduced through an early digital asset deployment to validate technical feasibility, settlement mechanics, and market demand within existing blockchain ecosystems.

Early activity confirmed viability.

What followed was a deliberate and strategic evolution.Rather than remain a conventional token-based project, Honos entered a controlled infrastructure pause to strengthen:

Core settlement and execution architecture

- Cybersecurity, resilience, and system hardening

- Regulatory compatibility and institutional alignment

- Long-term governance and deployment frameworks

- This decision repositioned Honos away from speculative markets and toward sovereign-grade financial infrastructure, suitable for public-private integration and national-scale use.

Integration into a Sovereign Economic Framework

Honos is now being formally integrated into the Sovereign Gold Platform (SGP) and the broader ASE-PAC economic architecture, positioning it within a protected, institutionally structured financial environment.

This integration enables:

Enhanced governance, oversight, and system security

- Alignment with national energy, infrastructure, and economic priorities

- Compatibility with government, banking, and regulated financial systems

- Scalable deployment across energy, manufacturing, trade, and infrastructure corridors

Honos functions as an infrastructure layer, not a standalone asset—supporting policy-aligned capital movement, settlement, and value coordination.

Why Honos Infrastructure Matters

🔹 Energy-Aligned Financial Architecture

Designed to operate in coordination with clean, efficient, and resilient energy systems, reducing friction between energy production, economic activity, and financial settlement.

🔹 No Energy-Intensive Mining

Built without proof-of-work or extractive mining models, supporting low-carbon, high-efficiency financial infrastructure.

🔹 Institutional & Government Ready

Engineered for compliance, scalability, auditability, and governance, suitable for large economic systems—not retail speculation.

🔹 Strategic Sovereign Alignment

Integrated into a broader framework designed to enhance financial resilience, energy independence, and long-term economic stability.

🔹 Enterprise & National-Scale Applications

Applicable across:

Payments and settlement

- Infrastructure and project finance

- Trade and cross-border value coordination

- Energy-linked economic activity

- A Platform for the Next Era of Finance

Honos represents a new class of digital financial infrastructure—where energy systems, economic policy, and financial rails operate in coordination, not isolation.

As governments and institutions worldwide prioritize:

Clean and secure energy

- Supply-chain and industrial resilience

- Domestic manufacturing

- Secure, auditable financial infrastructure

- Honos is positioned to serve as a foundational layer within next-generation economic systems.

Looking Forward

The future of finance is infrastructure-driven, energy-aware, and institutionally aligned.

Honos is being built for that future.

A cleaner, stronger, and more resilient financial system is emerging—

and Honos Infrastructure is engineered to be part of its core architecture.Honos operates as digital financial infrastructure within an institutionally governed framework. It is not designed or marketed as a speculative retail asset.

About Us

Our Mission

To work alongside the world’s most capable entrepreneurs, executives, and institutions in building enduring companies, resilient economic systems, and transformational enterprises—guided by faith, discipline, and principled leadership.

We believe that lasting success is created when excellence in execution is aligned with strong moral foundations.

Our Vision

Rooted in integrity, stewardship, and service, our vision is to deliver exceptional outcomes while honoring timeless ethical principles drawn from Judeo-Christian traditions and shared moral wisdom.

We operate with:

Integrity in decision-making

Care for people, institutions, and communities

Passion for excellence and impact

Transparency in leadership and execution

These values inform how we advise, build, and lead—ensuring that growth is sustainable, success is earned, and outcomes create long-term value.

We seek to inspire individuals and organizations to achieve their highest potential while remaining grounded in faith, responsibility, and respect for human dignity.

Our Commitment

We are committed to:

Building organizations that last

- Creating value without compromising principle

- Serving with humility and purpose

- Leading with courage in complex environments

- Success, in our view, is not measured only by scale or capital—but by impact, legacy, and alignment with enduring values.

Resources

Consultant

Coaching

Speaking

Consulting

Global Funding

Loans

© 2022-2025 RDE GROUP.